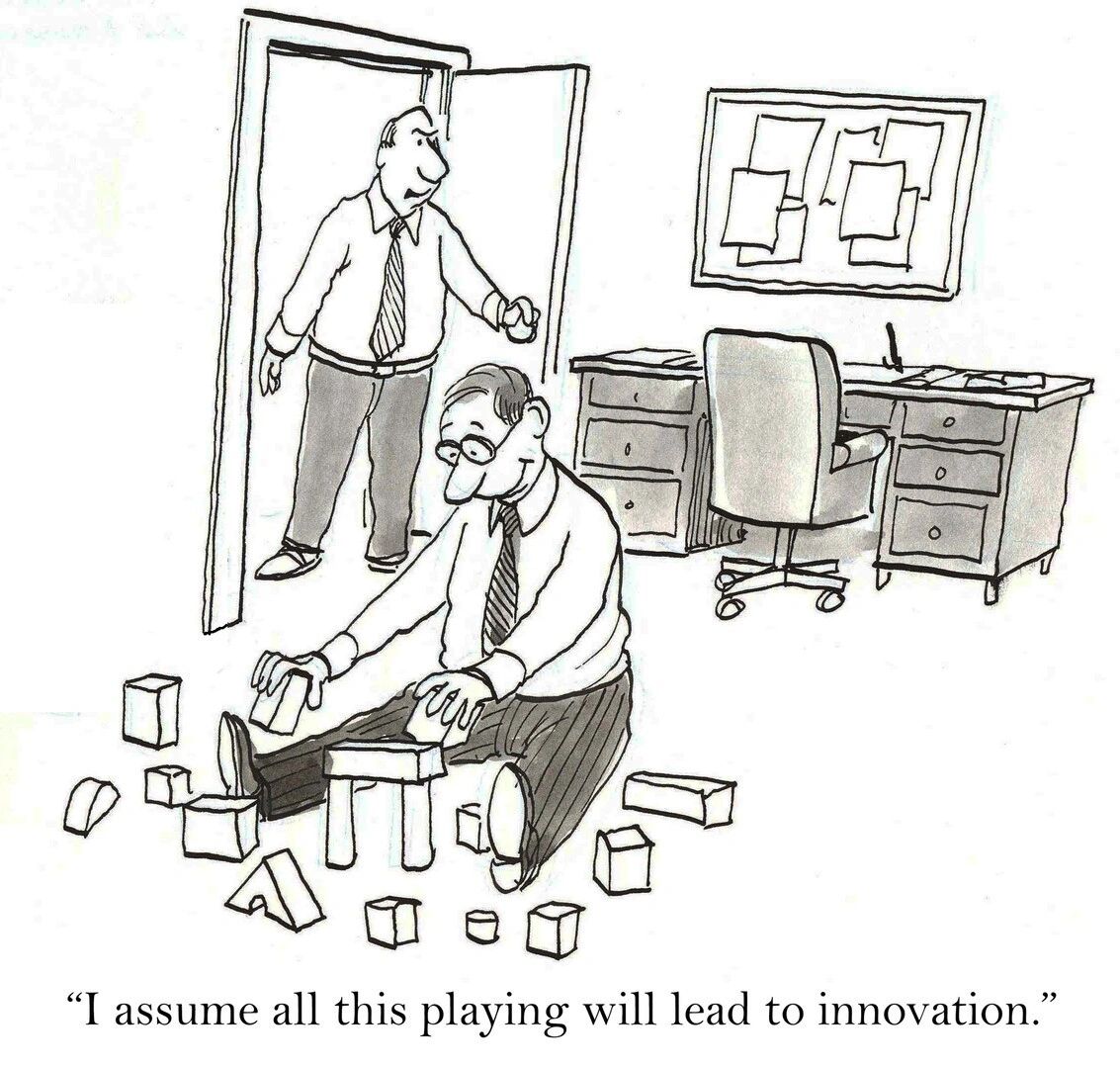

Innovation and R&D

Most manufacturing and supply chain companies innovate, many on a daily basis without realising it, often under the guise of continuous improvement or business development. The UK government supports businesses that innovate and undertake R&D via the R&D tax credits.

If you innovate within your business there is a good chance that you can claim R&D tax credits which are instantly removed from your tax bill, which in turn can significantly assist your cashflow. There are 3 main areas where R&D innovations can occur:

Innovation and Research & Development

Automation & Technology (including software & Systems)

Innovation and Research & Development

Process – Development of specific process to your organisation that provides benefits such as customer service / satisfaction, productivity and growth or efficiency.

Product

Automation & Technology (including software & Systems)

Innovation and Research & Development

Product – Development and launch of new products or services to the market, new innovative products, packaging changes, customer experience, delivery improvement (order day 1 for day 2 delivery).

Automation & Technology (including software & Systems)

Automation & Technology (including software & Systems)

Automation & Technology (including software & Systems)

Automation & Technology – The development of bespoke solutions that may include the modification of existing systems to meet your specific business requirement. This may be systems or software driven or new equipment capabilities in your manufacturing, suppliers, distribution network capabilities.

E2E SCE can partner with specialist R&D credit accountants to help you identify areas where you have already innovated, future opportunities and then realise the additional benefits via UK Government tax credits.

Let us innovate with you, E2E SCE has the benefit of expriencing the best aspects of many different industries and sectors taking the best transferable practices and help you implement them into your systems and processes and potentially automating those leading to improved efficicncies and profitability.

Copyright © 2020 E2E Supply Chain Excellence Ltd - All Rights Reserved.